A legacy of quality and innovation since 1836

A legacy of quality and innovation since 1836

A long-established and proven track record

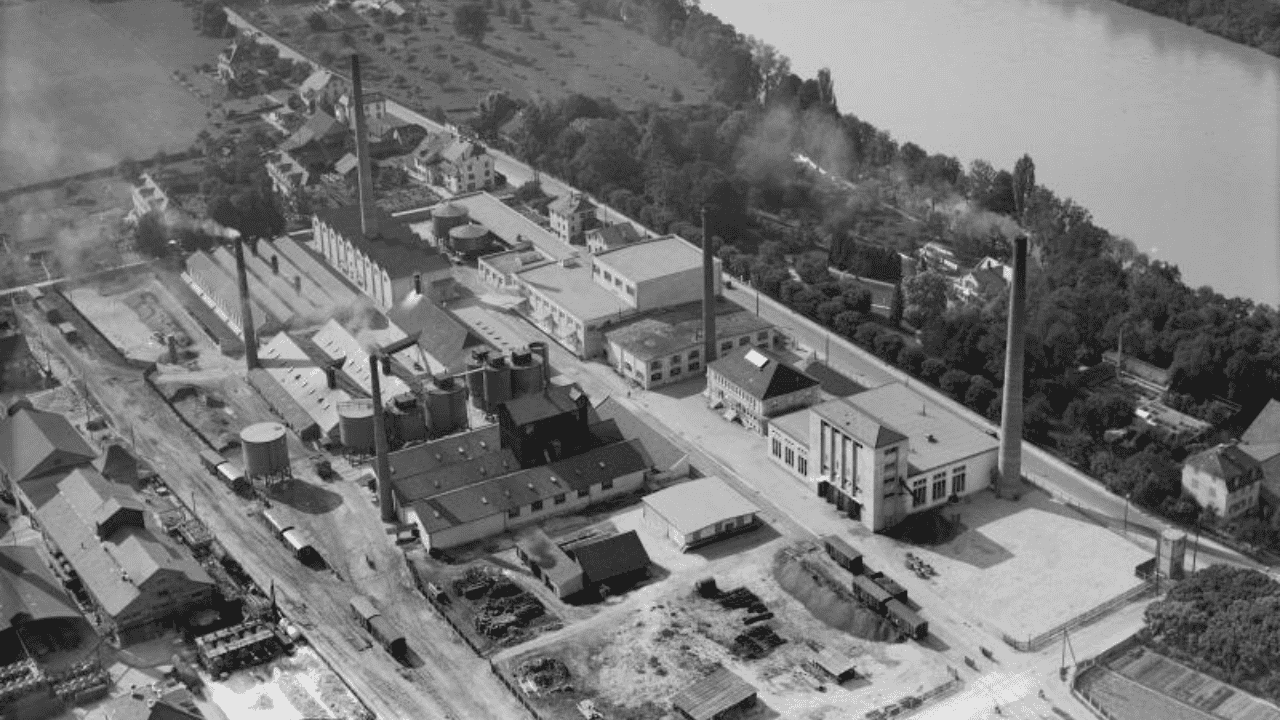

Founded as a saltworks operation in Basel, Switzerland, Acino—formerly “Schweizerhall”—has evolved over nearly two centuries. Expanding from chemicals to pharmaceuticals and biotechnology, the company went public in 1994 and sharpened its focus on advanced drug delivery. Strategic acquisitions, including Cimex Pharma AG in 2004 and Novosis AG in 2006, have strengthened its position as a leader in complex solid oral dosage forms.

1836

Foundation of “Schweizerhall” near Basel.

1994

Schweizerhall goes public at SIX Swiss stock exchange.

2004

Acquisition of Cimex Pharma in Liesberg, Switzerland.

2006

Acquisition of Novosis in Miesbach, Germany.

2008

Change of the group and subsidiaries name to “Acino” (a blend of Cimex Pharma and Novosis)

2011

Acquisition of combined Middle East and African Business of Cephalon.

Acquisition of Mepha’s production and R&D facilities and the business in MEA, LATAM and Asia. Commercialization of products under the brand “Acino Switzerland”.

2013

Takeover by Avista Capital and Nordic Capital – Acino is delisted from the stock exchange.

2014

Acquisition of Copharm in Russia.

Delisting of Acino Holding AG from the SIX Swiss Exchange (read more)

2015

Acquisition of Pharma Start in Ukraine (read more).

2016

Acquisition of MENA operations and product rights from Norgine (read more).

Aquisition of Takeda’s manufacturing plant in Põlva, Estonia (read more).

In–licensing agreement for the combination painkiller Maxigesic of AFT.

Divestment of Novosis patch and implant business.

Headquarters move to Zurich.

2017

Acquisition of Litha Healthcare in South Africa (read more).

Distribution partnership with Merck in the CIS (read more).

2018

Acquisition of Women’s Health portfolio in Russia.

2019

Acino opens new offices in Türkiye and Egypt.

2020

Acquisition of parts of Takeda’s primary care portfolio in selected countries in the Middle East, Africa, and Ukraine (read more).

Acino receives EU GMP certification in Ukraine.

Acino attains B-BBEE certification in South Africa.

2021

Acquisition of IlmixGroup portfolio and pipeline in Russia (read more).

Acino and Pharmax collaborate to align with UAE’s strategy to become a regional pharmaceutical manufacturing hub (read more).

Merz Therapeutics and Acino sign distribution agreement in Ukraine, CIS and Mongolia (read more).

Abu Dhabi based ADQ, one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors, signs agreement to acquire Acino.

2022

Takeover by ADQ investment and holding company.

Acquisition of selected Aspen’s brands in South Africa (read more).

2023

Integration of Pharmax Pharmaceuticals (read more).

Divestment of Acino Russia. Acino no longer does business in Russia.

Acino significantly expands presence and capabilities in Latin America through acquisition of M8 Pharmaceuticals (read more).

2024

New regional leadership and hub in Latin America (read more).

Portfolio expansion with several novel products (read more).

Acino is part of Arcera (read more).

2025

Acino attains Level 1 B-BBEE status in South Africa for the fifth year in a row and is recognized as a Top Employer for the fourth consecutive year (read more).

The story continues